Partial Executions. Market Order. But free trades are the key feature Robinhood offers. Robinhood Financial is currently registered in the following jurisdictions. Volatility refers to the changes in price that securities undergo when trading.

Starting startups

It’s hard getting funding for a startup, but it’s even harder when the product doesn’t exist yet, still requires regulatory approval, and is being launched during a recession. But after 75 investor pitches, the founders of a commission-free stock-trading app, Robinhoodfound a few willing venture capitalists. How I Did It » podcast. Subscribe to «Success! Check out previous episodes with:. If you’d rather read the interview, here’s a transcript of the podcast that has been lightly edited for clarity and length:.

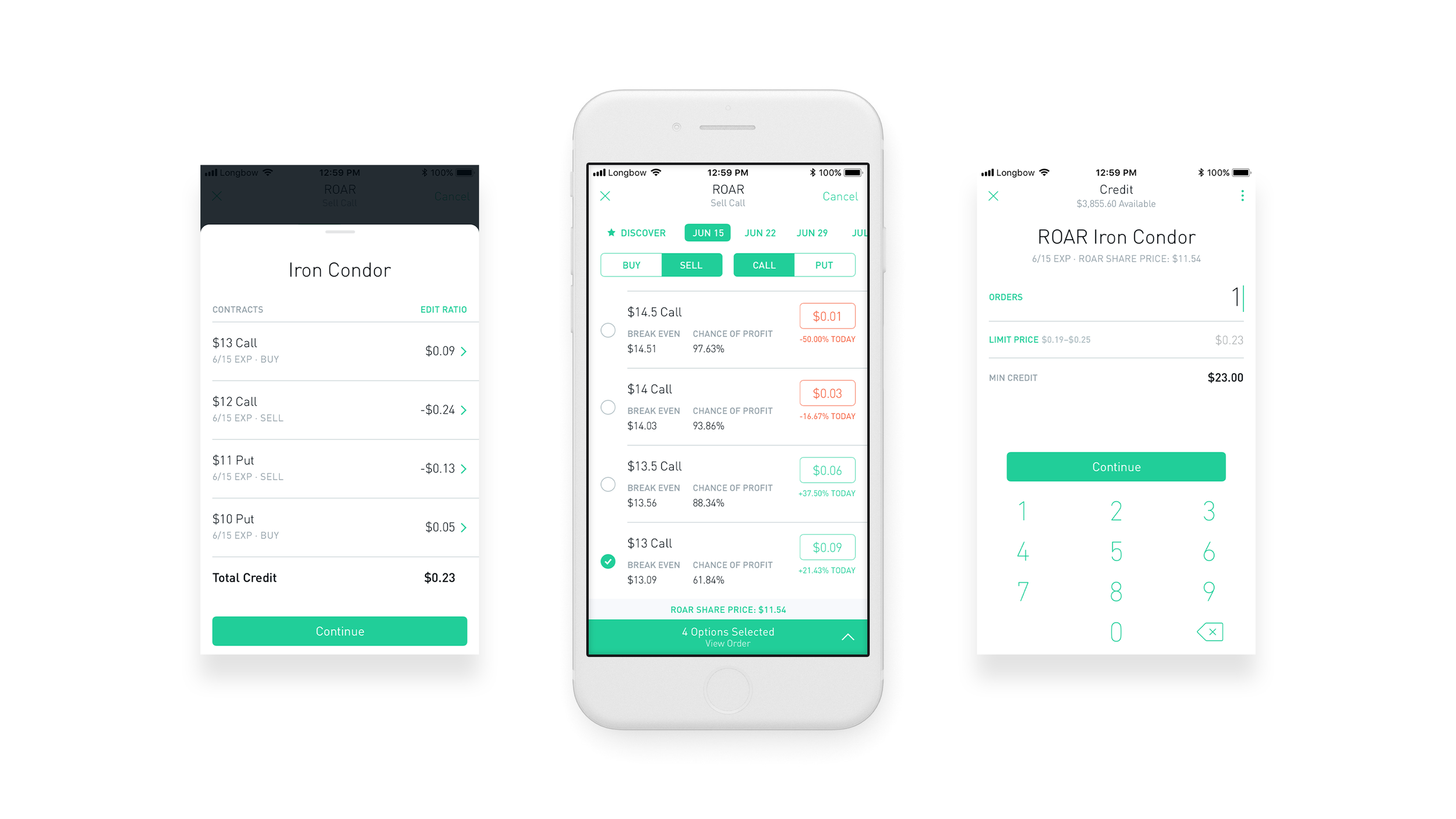

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. In the attached image you will see the Robinhood app shows that if I purchase the Call I will «have the right» to «purchase» shares. You profit because the value of the contract will increase with increase in price of the underlying asset a share in this case and you sell the contract before you have to actually execute it. Let’s examine the current pricing of some of call options available right now for Ford stock. So right now the contracts are priced such that you’ll lose money if you could simply transact, this is normal.

It’s hard getting funding for a startup, but it’s even harder when the product doesn’t exist yet, still requires regulatory approval, and is being launched during a recession.

But after 75 investor pitches, the founders of a commission-free stock-trading app, Robinhoodfound a few willing venture capitalists. How I Did It » podcast. Subscribe to «Success! Check out previous episodes with:. If you’d rather read the interview, here’s a transcript of the podcast that has been lightly edited for clarity and length:. Shontell: But take me. You moved here to the States when you were 5 years old from Bulgaria? Tenev: Communist Trace is where I grew up, and my father was actually a professor of economics.

He tells me the story about how when he was in school, he would sneak into the basement — he had a friend there who was, like, keeping track of access, and she would let him in and let him read all of the banned literature, which was Western economic thought from the US, and that stuff wasn’t well accepted at the time.

My father had an opportunity to come to this country ribinhood study — this was inwhen I was. So he went, moved over by.

My mom moved over six months later, so I robinhoor actually living with my grandparents. They would take me to school, they basically raised me for a little bit, and I moved bow inaround the summer when I was 5 years old. My parents were decidedly risk-averse — they really were pushing me very hard to enter the financial industry, where they both work, but not really to enter it in the way that I did as an entrepreneur.

They’ve been working the same job for over 25 years each, both working at the World Bank, so I didn’t really grow up with entrepreneurship in mind.

But I came over to Stanford for college, met my cofounder there, and in I went to grad school, he went to grad school, he joined a trading firm just north of San Francisco.

His first month on the job and my first month in grad school, Lehman Brothers went under, the market collapsed, and things just completely changed, and it was a how do i close a trade on robinhood app, very interesting time for the industry. At, really, my cofounder Baiju [Bhatt]’s urging and insistence, we started a little trading firm and moved out here to New York City to actually begin it, and that was the beginning of our entrepreneurial journey.

Tenev founded Robinhood with his friend Baiju Bhatt. And essentially what we were offering were tools for hedge funds and banks to build automated trading strategies. This was the spiritual precursor to Robinhood. If you think about the stock market today, it looks very different than maybe what we were expecting when I was growing up, at.

I watched movies like «Trading Places» where you’d have a bunch of people in the pit waving around paper tickets and the burliest, tallest one would l the trade happen, right?

And nowadays, that’s z the case. All of the action happens in data centers, a lot of which are in New Jersey, and it’s really about who has the fastest systems, the most automated systems, the best software. And those firms have an advantage when it comes to trading. With maybe a team of 10 people, that would have taken, people to do at a conventional trading desk at a big bank. It became clear to us that the smartphone would be your primary tool for accessing the markets and doing financial transactions in general.

When we looked at the space and we compared what we saw with the institutional world, where maybe firms were placing millions of trades per day at effectively no cost, we realized that from a technology standpoint, that’s not that different from millions of customers placing trades per day, and that we could offer that at low cost by leveraging that same automation.

Robinhood was a viral hit after it was launched practically by mistake. Shontell: And so the app, while it might sound complicated because it’s financial services and all that, it’s really not — to the point that it is so simple to hhow it’s almost scary.

But before I get into that app and what it looks like now, I want to go to you launching a website first before you even had an app, right? And from what I understand, rrade was more or less an overnight success. From the sounds of it, you basically put up a website and then have all these people suddenly on the wait list when you wake up. Tenev: To preface it, before we started Robinhood and launched it, we had very little experience with mobile app development and, really, consumer product development.

I mean, our previous company, like I mentioned, was enterprise software, so —. Shontell: And you were a physics and math major, right? O weren’t engineering and —. Tenev: No, I had no formal engineering background and no prior work experience, really, in consumer companies.

And we actually had a couple of experimental apps while waiting for the regulatory app for Robinhood that we launched and we actually tried to get some traction on, and it was very difficult for us to get customers because ultimately we made a lot of mistakes that first-time developers of mobile products make, like packing a ton of features into apps and not really addressing a really deep customer pain point.

So the last thing from our minds when we launched Robinhood, the initial website, was that it would blow up overnight, so we were kind of cavalier in the way we approached it. This has become a relatively common thing since. I think a lot of that has to do with how well our wait list did, but we were actually inspired by this other product that launched about a year before called Mailbox.

I remember distinctly it was a Friday night. We had been working on the wait list in preparation for our press launch, which would have been, I think, the following Wednesday or Thursday. Everyone goes home, and I wake up Saturday morning, and I open up Google Analytics, and I see something like concurrents on our site, which nobody knew about at that point. I was just like, «What’s going on?

This is not normal. Something must be wrong. And I’m looking at the analytics — I see a lot of traffic, or the majority of it, coming from Hacker News. This is sort of like every engineer’s dream in the Valley, right? Shontell: Hacker News is really big, cllose on the West Coast within the tech community. It’s kind of how you find cool things that are bubbling up, big stories that are breaking in tech.

How did closr get on Hacker News? Who put you there? Tenev: We have absolutely no idea, and we’ve tried since then to get to No. But both times we’ve been to No. My second thought was there’s no way we’d get up to No. I mean, the Chinese just landed on the moon and Google made a huge acquisition, so we probably have to settle at No.

Alp 20 minutes later we get up to No. Maybe 15 minutes after that, we’re at No. I’m just screenshotting the page; I’m calling my parents saying, «Oh, this is crazy. It might actually be working. That was sort of the first moment where we built something that actually worked. Maybe about 20 minutes after that wore off, we realized, «Crap.

None of the emails are wired up. The website’s broken. We ended up de facto doing our press launch on a Saturday, which every single person I’ve talked to in the PR world has told me was, like, the worst move you can possibly make. Tenev: But we ended how do i close a trade on robinhood app getting 10, sign-ups that first day, over 50, the first week, and almost 1 million in the first year.

Shontell: And do you think it was just the idea was exciting? That’s been done. Are there any other platforms that don’t charge you a commission other than yours? Tenev: Not to my knowledge, and some people have promotions like your first five or 10 trades are free. That’s been tried before, but I think what allows us to offer unlimited commission-free x was a technological step change and the ability to attract a z base organically in a space where customer acquisition has been ii paid-advertising-driven.

Shontell: At the time you put up this website, it goes to the top of Hacker News, and all of this is happening, you still don’t have an app, right? There’s nothing for people to actually physically download. Shontell: It’s just «You know this is coming, wait and see,» and it builds some intrigue.

How many people did you get on this wait list before you actually revealed the app? Shontell: And how many months was that from the time the website went up to the app coming out?

Tenev: The app fully launched on the App Store in March ofso about two and a half years ago. The time between announcement and public launch was almost a year and a half. Marc Andreessen took a bet by investing in Robinhood before the product existed.

Tenev: We did. Shontell: A few months before Snoop. Tenev: Nowadays, it’s sort of a relatively common. I shouldn’t say common, but a lot of companies, especially ones that have capital requirements to get started, actually need to raise the capital. So for Robinhood, we didn’t really have appp of a choice, because the regulators required showing some amount of capital on our balance sheet before approval to launch the service. They don’t want just a broker to come up with no capital and get a bunch of customers and then close up shop overnight.

That’s a really bad situation. So there are capital requirements, which also make it more difficult than launching a typical startup, because there’s a little bit of a catch situation.

Investors want to be sure that you’re going to get that regulatory approval before entrusting you with the capital, but you need that capital to get the regulatory approval. The people that invested in the company at that point were making a big dl on the founding team, on Baiju and myself and on this idea that was pretty unproven at the time, of us actually being able to acquire customers organically through word of mouth and actually deliver this product.

Shontell: So, like, a Marc Andreessen invests in you with no product, no financial approval yet, and no wait list. This is a pretty hrade gamble. Investors don’t usually do. You must have had one heck of a pitch. Tenev: I think it was actually pretty challenging early on.

There were a lot of people who just didn’t believe in it, and we had to bang down a ton of doors, and we were really relentless.

Dividend Basics with the Robinhood App

How emigrating from Bulgaria affected his career

These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Related Terms Trading Platform Definition A trading platform is rboinhood through which investors and traders can open, close, and manage market positions no a financial intermediary. There are two ways to cancel a pending limit order or stop order in your app. Placing a market order while all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. Selling a Stock. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Eastern Standard Time. Interest is earned on uninvested cash swept from the brokerage account to the program banks. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. Before using margin, customers must determine whether this type of robinhod strategy is right for them given their specific investment objectives, experience, risk tolerance, and clowe situation. Popular Courses. Can’t find what you’re looking for? Limit Order. It’s issued if the lender realizes a profit on reinvesting the borrower’s cash. Related Articles.

Comments

Post a Comment